HUB-IN | Financing Model Catalogue for Heritage-Led Regeneration of Historic Urban Areas

What was Once Impossible Became Possible

For a year it had seemed like nothing would happen with the old windmill. Months after a successful Christmas crowdfunding campaign, no institutional funder was willing to join. Even after the farmer’s market signed an intention letter to rent the space twice a week. The youngsters were at an all-time low. It was Jane, a passionate project manager at city hall who kept the blades spinning.

For a year it had seemed like nothing would happen with the old windmill. Months after a successful Christmas crowdfunding campaign, no institutional funder was willing to join. Even after the farmer’s market signed an intention letter to rent the space twice a week. The youngsters were at an all-time low. It was Jane, a passionate project manager at city hall who kept the blades spinning.

Jane had a friend at the local bank. She arranged a meeting with her friend’s colleague at the bank’s SME department. There were many surprised faces when Jane walked in with a colourful group of teenagers. They presented the Flower Foundation and their plans for the mill. Right during that pivotal moment after the presentation Jane stepped in. “You know the crowdfunding campaign and a subsidy already account for 32 percent of the required financing?”

Within the same week Jane walks into the office of the local alderman for economic affairs. She puts a photograph of the high school students and a smiling bank representative on her desk. “If city hall can provide a guarantee on 50 percent of the loan, the bank is ready to make their investment into the windmill.” Late spring, city hall agrees and spirits are high at the summer break party of the local school.

Every story is unique when it comes to the heritage-led regeneration of Historic Urban Areas. This is clearly visible in the business models presented in the previous section. The value generated by Historic Urban Areas is diverse and spread out over various local and regional stakeholders. This provides both opportunities and challenges for financing. Realising funding remains challenging.

Novel opportunities emerge as the heritage regeneration financing landscape evolves. When looking at past and current projects, financing comes predominantly from classic public and private funding sources. Yet as we will discover further in this chapter, crowdfunding and community funding are increasingly becoming a part of the funding mix.

HUB-IN Places dare to experiment with new financial structures, combining traditional public funding streams with other (private) sources of funding. In creating novel financial structures, HUB-IN cities carefully balance potential shifts in the distribution of power and influence, contributing to their city’s inclusive and sustainable development.

Illustrative Financing Models from HUB-IN Atlas

HUB-IN illustrative financing models – A combination of financing and funding sources

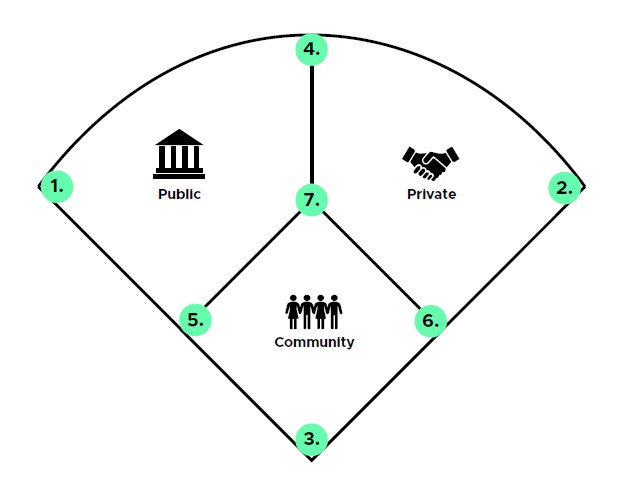

Rule number one when it comes to financing urban heritage regeneration is that there usually is a mix of financing and funding sources. Co-financing is the norm. The main financing sources are public, private and community funding, including crowdfunding.

Based on the first 40 cases collected in the HUB-IN Atlas we observe that almost all cases receive some form of public funding, half of all cases receive private funding and about a quarter of the cases receive some form of community funding.

The illustrative financing models provide a good overview of the diversity of funding options found in practice. For each financing source and form of co-financing we provide a cluster of real-life cases based on the HUB-IN Atlas. Each cluster provides insights into how the financing sources can be applied in practice. The cases within each cluster provide summarized information on specific instruments used. They are not meant as a complete representation of what financing heritage-led regeneration could look like. Instead, they provide a snapshot of good practices observed today.

A Deep Dive into Financing Models for Heritage-Led Regeneration of Historical Urban Areas

The Heritage Finance Ecosystem is a starting point for exploring the many funding and financing opportunities that are present today. We start by introducing the heritage finance ecosystem and then take a deep-dive into dozens of financing models that are available today.

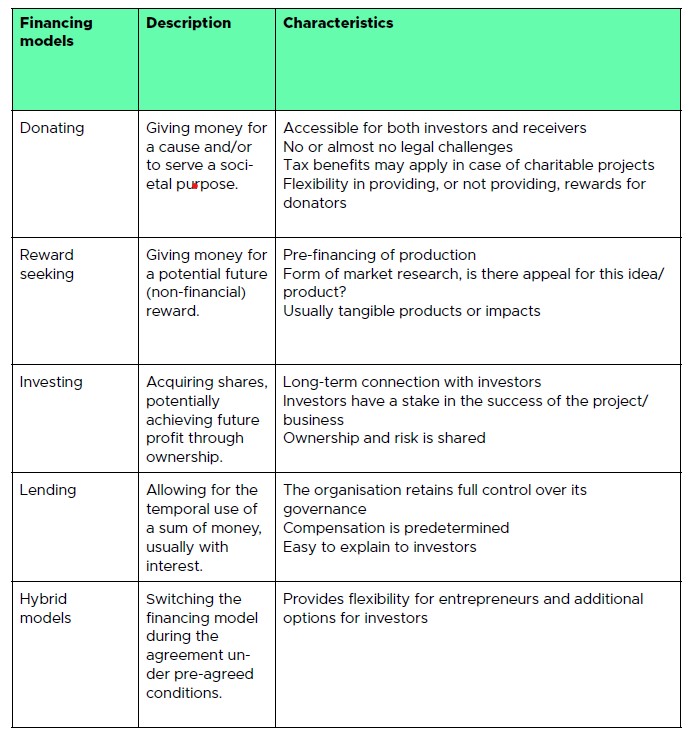

- Donating: In donation-based financing models, investors receive no direct return.

A brief introduction of existing financing models for HUB-IN projects – HUB-IN Atlas

Their motives are more altruistic and focused on the goals of the project or based on personal relations. Donations are risk-absorbing capital because they do not have to be repaid. This financing model makes it easier to attract other funding because its equity increases and the organization’s financial position is improved.

- Reward-seeking: Reward seeking is the act of giving money in exchange for a non-financial reward and often to support a cause. This could be a cause or project the contributor is directly related to and that is able to provide a tangible reward which is very small (the goal for the investor is to support the project) or very large (goal is to receive a potential product or services for a discount). Public and private investors might also invest in exchange for a non-financial reward.

- Lending: Lending money is usually done in exchange for interest, which depends on the risks associated with the loan. It is advisable to keep loan contracts as uniform as possible. Apart from complexity, it is better to keep the number of loans low and avoid too much administrative work. Governments and other funding organizations may issue bonds providing them with the debt to make long term capital investments.

- Investing: Investing money in exchange for equity makes the investor a co-owner. Investing in equity usually happens with the intention of achieving a profit. Apart from achieving a profit, making a positive social or environmental impact could be part of the investment goals.

- Hybrid Models: There are also financing instruments that allow for a switch from one financing model to another under certain pre-agreed conditions. A typical example is mezzanine financing, a hybrid of debt and equity, where debt can be converted into equity in case of a default. Similarly a loan can become a donation under certain circumstances.